Vortex Weather Insurance now offers expanded supplemental hurricane coverage that helps protect businesses against all hurricane categories (1-5), providing fast, hassle-free payouts for any financial losses caused by the storm, including flood, storm surge, wind, and business interruption. This innovative coverage helps fill critical gaps in traditional insurance policy protection.

Understanding Hurricane Categories and Their Impacts

Hurricane Categories by Wind Speed and Typical Damage:

- Category 1: 74-95 mph winds – Dangerous winds causing some damage to roofs, shingles, vinyl siding and gutters

- Category 2: 96-110 mph winds – Extremely dangerous winds causing extensive damage to homes, businesses, and vegetation

- Category 3: 111-129 mph winds – Devastating damage, with major damage to buildings and uprooted trees

- Category 4: 130-156 mph winds – Catastrophic damage with severe building damage and long-term utility disruptions

- Category 5: 157+ mph winds – Total destruction of many structures, areas uninhabitable for weeks or months

Vortex’s parametric hurricane insurance uses objective data from the National Hurricane Center to trigger automatic payments without requiring claims adjusters, financial documentation, or inspections.

Revolutionary Approach to Hurricane Protection

Unlike conventional insurance policies that, in many cases, require lengthy claims processes and adjuster visits, parametric hurricane insurance operates on a straightforward principle: if a hurricane’s recorded path enters your coverage zone, you receive payment based on the recorded storm intensity. This innovative approach eliminates the traditional hurdles of claims processing and documentation requirements.

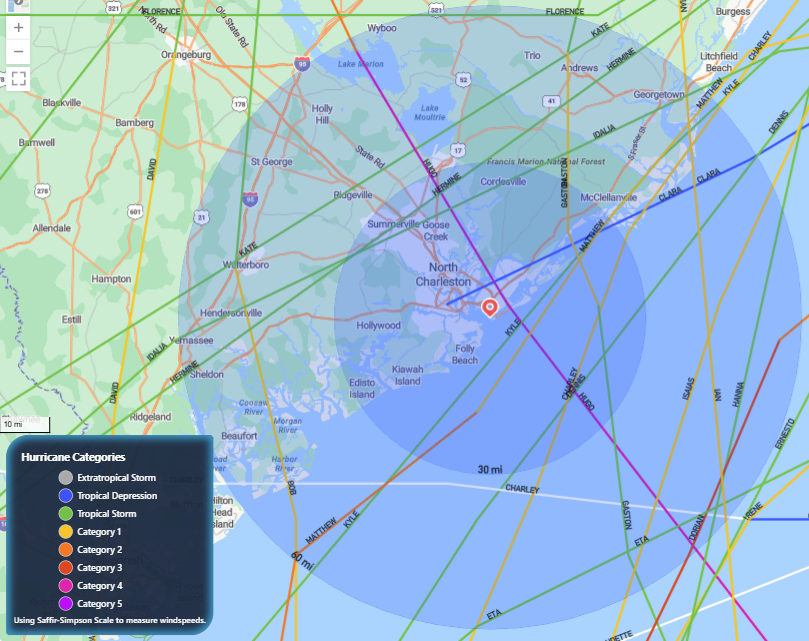

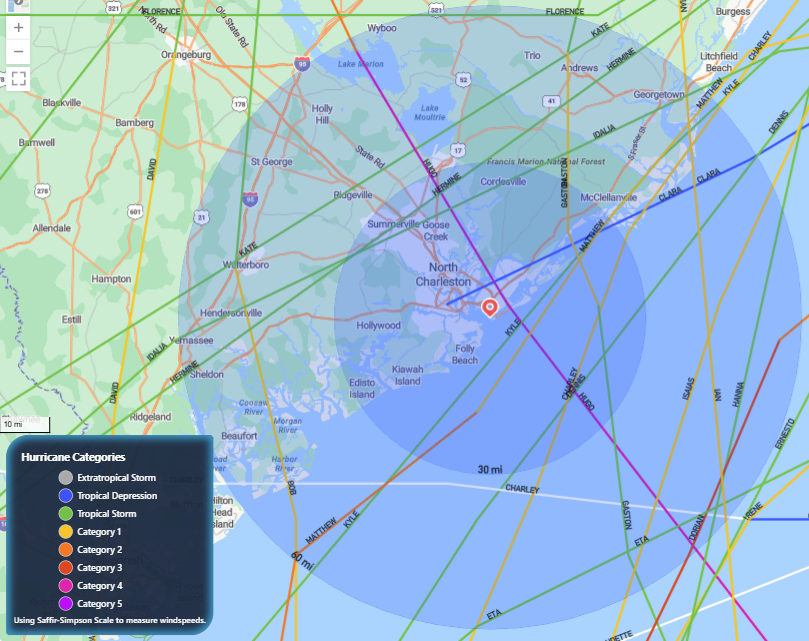

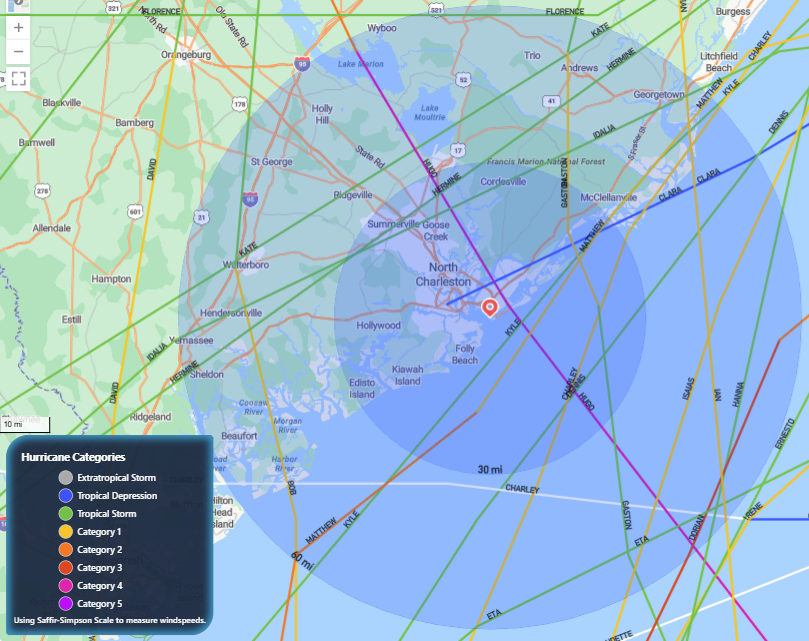

The coverage structure offers two primary protection zones:

- Coverage when a hurricane storm track of any category (1-5) passes within 30 miles of your business

- Extended coverage when a Category 3+ hurricane storm track passes within 60 miles

When the recorded qualifying storm track enters your coverage zone, payment is automatically triggered based on storm intensity – no paperwork or adjusters needed.

Fast, Technology-Driven Claims Processing

Vortex leverages National Hurricane Center data to track storms and trigger payments automatically. This system enables:

- Claims processed and payouts mailed in under 30 days

- No proof of loss requirements

- No deductibles

- No complex documentation

The elimination of traditional paperwork and adjuster requirements means businesses can focus on recovery rather than documentation. This efficiency is particularly valuable in the aftermath of a storm when resources and time are stretched thin.

Flexible Hurricane Insurance Coverage Options

Businesses can secure coverage up to $500,000 through Vortex’s online portal, with higher limits available through local licensed agents or Vortex agents. Any licensed agent who offers commercial property & casualty insurance can register to provide Vortex coverage.

Multiple Storm Protection

Your Vortex policy maintains protection throughout hurricane season. If multiple qualifying storms affect your coverage area within the same year, your policy continues to provide protection (subject to remaining policy limits).

Securing Your Hurricane Coverage With Vortex

Coverage begins 30 days after purchase, making it essential to secure protection well before hurricane season begins. The online enrollment process takes just minutes through the Vortex Insurance Portal.

Why Choose Vortex Supplemental Hurricane Insurance

Vortex’s parametric hurricane insurance helps to fill critical gaps typically included in traditional coverage. Benefits include:

- Fast payouts for flood, storm surge, wind, and business interruption

- No complex claims process

- Automatic payments based on objective storm data

- Coverage for all hurricane categories

- Flexible payment triggers

For businesses in hurricane-prone regions, Vortex supplemental hurricane insurance provides an essential layer of protection beyond traditional property insurance. With increasingly unpredictable weather patterns, having this coverage is crucial for business sustainability.

Securing Your Business’s Future With Vortex Supplemental Hurricane Insurance

The expansion of hurricane insurance to cover all categories (1-5) represents a significant advancement in business protection options. With increasingly unpredictable weather patterns, having hurricane coverage is no longer optional for coastal businesses – it’s a necessity for long-term sustainability.

The combination of rapid payouts, broad coverage options, and zero deductibles makes modern hurricane insurance an essential tool for business risk management. By understanding your coverage options and securing appropriate protection, you can ensure your business is prepared for whatever weather challenges arise.

For businesses operating in hurricane-prone regions, now is the time to review your current coverage and consider whether supplemental hurricane insurance could provide additional security. The peace of mind that comes with knowing you’re protected against all hurricane categories is invaluable in today’s uncertain climate.

Remember, proper insurance coverage is just one component of a comprehensive hurricane preparedness strategy. Regular review and updates of your protection plans ensure your business remains resilient in the face of severe weather events.