As the old saying goes, “for everything there is a season.”

When everything includes 157+ mph winds, torrential rainfall, flooding, ripped-off roofs, shattered glass, bent steel, obliterated inventory, and days upon days of zero revenue, that season is called hurricane season.

Because of the destruction a hurricane can cause, insurance is a must for businesses along the eastern coastline and the Gulf of Mexico. The problem is, when a hurricane makes landfall, there’s often a shortfall between what your company’s hurricane insurance covers and the total of your deductible and revenue losses.

Vortex Weather Insurance offers supplemental hurricane insurance that requires no financial deductible, and when triggered, pays out even if not one shingle is mangled or business day is busted.

Contact our team of weather pros at Vortex for more information, and read on about help covering the gap in your current hurricane insurance.

Our online portal makes it easy to build your policy in minutes.

Hurricane insurance helps you navigate destruction

Hurricanes destroy so much, including a business’s ability to operate in the aftermath. The detrimental effects are several, and can last for years.

Property Damage

This is the most obvious way that hurricanes negatively impact businesses. For small businesses, that damage can be devastating, and threaten—or end—that company’s future.

Cleanup Costs

Cleanup not only has immediate costs associated with the tools, products, extra staff, and time needed to address the mess, it can also be debilitating for any enterprise. The process requires a temporary ceasing of operations, which stops the revenue stream.

Insurance Increases

According to a report from the Congressional Budget Office, the costs associated with hurricane damage are going to increase more rapidly than the economy will grow. And as those costs increase, so does the price of traditional hurricane insurance.

Loss of Clientele

When your regular clientele are fighting to rebuild from their own business interruption, they may not have money to spend with your business. If your revenue relies on residential spending, you’re likely to see a decline in sales or business activity.

Business Interruption

There are many reasons your business could get interrupted. Maybe there was damage to your location/equipment that stops you from opening/operating. There might be government-mandated road closures. Or utilities are down and won’t be back up for an extended period.

Whatever the cause, if you have traditional business interruption insurance, it typically includes a 48 to 72 hour waiting period before any coverage is triggered.

Non-damage business interruption is very common with hurricanes. Maybe the business was 10+ miles from the heaviest impacted area, received little to no damage, but is unable to open due to wide-spread stay-at-home orders.

The problem is, you have to prove you were unable to continue business. You will also have to provide all of the receipts from years ago to prove your revenue loss occurred due to a covered business interruption. And then you have to wait for several days before the policy triggers. Not to mention other limits or exclusions that may apply.

Reputation Damage

When a publicly traded company reports hurricane damage in their annual financial performance report (10-K), data shows their stocks take a 5% drop in value over the next 12 months.

For whatever reason, customers seem to be hesitant to do business with a company that has suffered a loss from hurricane damage. It can take years to recover from this kind of disaster.

Supply Chain Interruption

Depending on the devastation from the hurricane, product supplies and repair/rebuilding supplies can be disrupted, leading to shortage not only of product, but also of labor.

Infrastructure Damage

In 2018, hurricane Michael damaged a majority of businesses in Panama City Beach, Florida, and surrounding areas.

The community rebuild was so prolonged that many residents moved away to find jobs. Michael took almost a year to be labeled a Category 5, which then released significant federal aid. But the damage was done, and it took a LONG time for the economy to recover.

Power Outages

Just the thought of the damage caused by these high-category hurricanes makes us want to hug utility workers!

The aftermath of a storm can last for days, weeks, and even months. Those power outages can mean employees can’t get to work, or work can’t be done at all. Productivity drops, customers are lost, and the cost to a business’s bottom line continues.

Loss of Tourism Dollars

Tourism dollars drive many industries, from entertainment, convention, and food and beverage business, to infrastructure support and growth. When the tourists dry up because of the damage, so do their dollars.

Tropical Storm or Hurricane?

The highest sustained (continuous) wind speed in the storm determines how a storm is categorized.

- 39 MPH or less = a tropical depression

- 40 to 73 MPH = a tropical storm

- 74 MPH or higher = a hurricane

As if this isn’t bad enough, hurricanes have a secondary distinction: major hurricanes. A major hurricane packs highest sustained wind speeds of at least 111 miles per hour or more. Gusts can reach over 200 miles per hour, a truly horrific fact.

Categories of Hurricanes

The Saffir-Simpson Hurricane Wind Scale defines the categories of hurricanes as follows:

- Category 1: 74 to 95 MPH

- Category 2: 96 to 110 MPH

- Category 3: 111 to 129 MPH

- Category 4: 130 to 156 MPH

- Category 5: 157 MPH and greater

For example, if your business is hit with a Cat 4 hurricane, that means the hurricane’s greatest sustained winds were between 130 and 156 miles per hour.

Vortex Hurricane Insurance for Supplemental Help

Our hurricane insurance is nothing like your typical insurance policies. Simply put, Vortex hurricane insurance is money you get because of the hurricane you got, not the damage or loss.

It’s Similar to Our Weather Insurance

Our hurricane policies operate in comparable fashion to our rain insurance policies for events. As a business owner who’s not an event promoter/venue or insurance broker/agent, you may not be familiar with weather risk management and parametric insurance.

Insurtech

Our ability to combine insurance with technology—insurtech—allows us to make parametric insurance more accurate, efficient, and effective. When we use the term “parametric,” we mean that specific parameters are used to analyze data and determine outcomes.

To illustrate how it works, let’s take a quick look at the way Vortex Weather Insurance helps protect revenue for events.

Building a Weather Insurance Policy

To build your customized, client-centric policy, we need 4 key pieces of information.

Event Location/Locations

Our rain insurance quote options use statistics from the National Oceanic and Atmospheric Administration (NOAA), specified by city and state.

Using the event’s physical location(s), we drill down to a 2.5 mile-square grid box surrounding it or them. For example, if a major soccer tournament occurs in several fields across a large metropolitan area, we can create policies for each physical location.

The Time Window

Weather insurance can include the day of the event, or just the most critical times. Event organizers can insure the hours leading up to their event, or any combination that best fits their weather insurance needs.

The Rain Threshold

Even light rain can impact the success of an event, so you get to select the threshold. We can assist you with understanding which rain threshold (amount of rain) makes the most sense as a payment trigger for their event.

Desired Insurance Limit

Because you don’t need to insure to value, you can choose the limit you want based on your unique risk and budget.

Did the Policy Trigger?

Vortex Weather Insurance uses National Stage IV gridded data to determine how much measurable rain fell during the policy period. If the threshold is met or exceeded, the policy triggers and the claim process goes into effect.

That means the client is paid their policy amount, period. They don’t have to prove loss, they don’t need to have canceled their event, none of that. If the rain threshold is met during the risk period, the policy pays out. That’s it. And the claim payment is typically mailed in less than 2 weeks.

How Our Supplemental Hurricane Insurance Works

When you purchase Vortex Supplemental Hurricane Insurance for your small business, this coverage lasts for a full year from the policy start date.

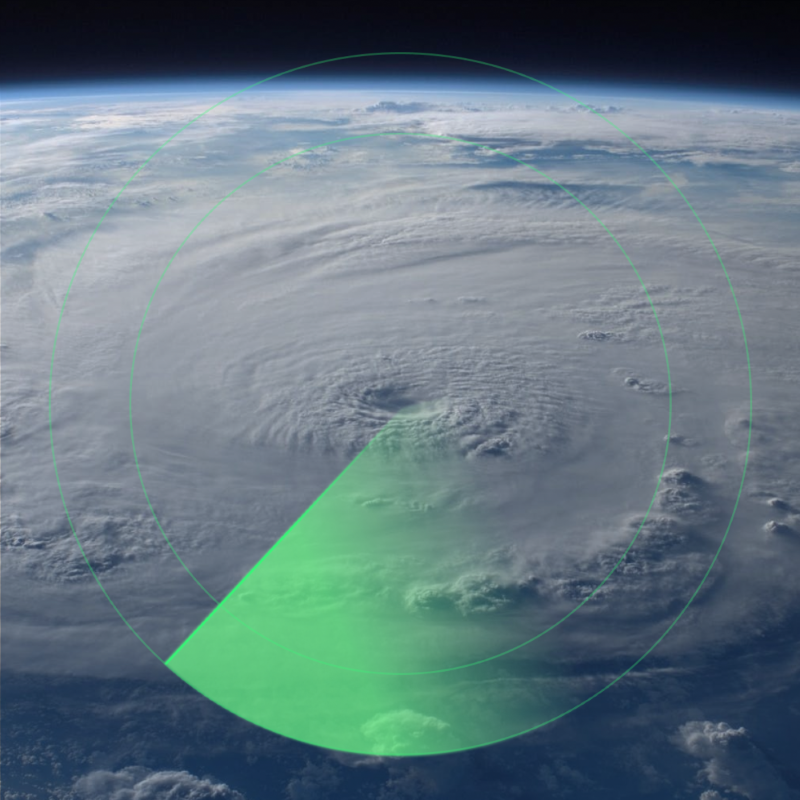

The policies available cover a 20 mile single circle or 20/40 mile double circle around your physical business address. If a storm track penetrates or intersects your coverage circle according to data from the National Hurricane Center at the National Oceanic and Atmospheric Administration, your policy triggers.

Final calculation of payment is based on the intensity of the hurricane as it passes through or intersects the coverage circle The storm must be Category 3 or higher at that time for a payment to be made. Payments increase as storm intensity increases and the track is closer to your business location.

And that’s it. You don’t need to prove damage to your business, no records of financial loss, no adjustors sent or inspections done or anything else. If the third party storm tracking organization shows that a storm track of sufficient intensity entered your coverage area, the policy triggers.

It’s that simple.

Why should you supplement your current insurance?

The claim adjustment process for some insurance companies can be a complicated and frustrating process. First, they send adjustors to make sure the damage you have qualifies as damage per the terms of the insurance policy.

And then they often require large deductibles—in the thousands to tens of thousands of dollars—and can take several weeks, months, or in some cases years to deliver payment.

Even if your insurance company is top notch, the full process may still take several months. In the meantime, how do you pay for damages? Or subsidize basic expenses as you rebuild? Or help bridge the huge, gaping money-hole your deductible left? Or make up for lost revenue extended by stay at home orders or reduced customer traffic?

A payout from your Vortex Hurricane Insurance Policy can help you do what needs doing. You might need to repair your warehouse roof. The plywood might not have fully protected your shop’s front windows. Maybe your refrigerated product spoiled while you waited for electricity to return.

You might even be trying to meet payroll for your staff, whose lives were also affected by the hurricane.

We don’t need proof of damage. We don’t send adjustors. We don’t need to know how you’ll spend the money. It’s not indemnity insurance, so there is no financial deductible and no line items to put on a spreadsheet, and no costs to haggle about.

If your policy triggers, our parametric insurance sends you payment in about two weeks, and that’s that.

We recommend securing a policy as soon as now

Vortex hurricane insurance lasts for an entire year, so waiting until the last minute doesn’t really do you any good. In fact, since your policy does not go into effect until 30 days following purchase, you should purchase as soon as you can.

Your policy will have a maximum limit – if a less intense storm impacts your location and you recover less than the maximum amount, your policy will remain in effect (with a reduced limit). This residual coverage remains like a safety net should another hurricane come your way.

Consider Locking In Your Vortex Supplemental Hurricane Insurance

It’s pretty simple: available now, use the Vortex Insurance Portal, or contact one of our Vortex weather specialists. You can review quotes, sign an application, and make payment. Thirty days later, your policy goes into effect.

Here’s an example: if a small business owner wants to cover a year starting on 2/10, they would need to purchase coverage by 1/12. Then the policy goes into effect on 2/10. Easy-peasy.

Hurricane season officially begins June 1 every year

The National Hurricane Center defines the hurricane season as June 1st through November 30th. You may purchase your policy anytime throughout the year, and 30 days from your purchase date the policy goes into effect for a full year.

It’s never a bad time to secure a policy, and you’ll have the insurance in place for a full year. The sooner we discuss your specific situation, the better prepared you’ll be.

Who can use Vortex Supplemental Hurricane Insurance?

Huge companies frequently have the corporate funds to help locations impacted by hurricanes. However, for small businesses without those kinds of deep pockets, the hurricane aftermath can reach so much farther with more dire consequences. Just a few of the small businesses that can benefit include:

- Restaurants

- Dry cleaners

- Landscaping/lawn care

- Theaters

- Golf Courses

- Car Repair

- Franchise owners

- And more!

With just a few clicks, the Vortex Portal offers quick and easy online pricing and purchasing using a credit card. Vortex can also support larger businesses, with more complex risk management strategies. Please contact Vortex about designing supplemental coverage for your existing insurance policies.

Weather Insurance and Hurricane Insurance

You might already have weather insurance as part of your business strategy. If your business location derives income from events—say, a convention hall, tennis facility, or golf course—you may want to add Vortex hurricane insurance to your rain insurance to help defray the impact of inclement weather!

Hurricane Insurance the Easy Way

Our Vortex Insurance Portal is the fastest, easiest way to lock down your hurricane insurance policy for the year. Open an account, fill in the details of the coverage you need, and within a few clicks you’re good to go for the year!

Vortex supplemental hurricane insurance purchased through the portal has a maximum possible payout benefit of $250,000. If you need more, contact us and let’s talk about your hurricane insurance needs. We may be able to help you ensure that your bottom line isn’t blown away by hurricane season.

For Hurricane Insurance, NOW is the Season

Don’t wait until it’s too late! Available now, use the Vortex Portal to purchase your Vortex Supplemental Hurricane Insurance Policy, and be ready for when Hurricane “YOUR NAME HERE” decides to blow through town.

Remember that with Vortex Weather Insurance, you don’t have to prove any damage, you don’t have to see an adjuster, you don’t have to incur any losses.

Our parametric insurance follows the storm. If the hurricane storm track crosses your coverage area, the hurricane’s storm track and intensity—as measured and recorded by the National Hurricane Center—dictates your payout. And that’s it. Payment will be mailed in about two weeks.

Contact us with your questions, and let’s talk about the weather. Our team of professionals is standing by, ready to help you protect your bottom line.